Provides a number of free and low cost services for checking credit history, including a free annual credit report, identity protection, and fraud alerts. Website has a simple interface with clearly labeled areas and services, along with information on how to make sure of your credit history.

Most free services are only for information tracked by Equifax. Information from all three credit bureaus is limited and expensive.

A great value for those who want a simple and inexpensive way to monitor their credit history.

All three (limited)

Yes (Equifax only)

Free (Payment required for advanced features)

No

Subscription service for continuous monitoring of your credit report. Provides access to numerous tools, including instant updates to credit report, personalized debt analysis, and ID theft insurance. Email notifications for updates to credit report are provided. Includes a toll-free phone number for support.

Some of the services included with the subscription are available elsewhere for free. Credit scores shown may not reflect the actual credit scores from the credit bureaus.

Credit report monitoring at a low monthly price provides a wealth of value for subscribers. Best for those who think the monthly subscription is worth peace of mind.

All three (limited)

Yes

Monthly Subscription

No

Free service for not only tracking your credit history, but also for tracking all aspects of your finances. Provides a wealth of free tools for checking credit, managing current finances, and even debt optimization services. Many of the tools provided are only available through most other services through a subscription or one time fee.

Users may get nagged by emails often. This is the price for a free service to consumers.

For anyone looking for free tools for checking their credit history and managing their finances, there are a few options that can even come close to Credit Sesame.

All three

Yes

Free

Yes

Similar to most other services. Provides a wide range of tools for closely tracking your credit history through a monthly subscription. Gives a choice for one bureau or three bureau credit reports, showing detailed information for all three. Mobile apps and toll-free support number are both available.

Monthly subscription is higher than most of its competitors.

This is the best service for those who need to see every small detail of their credit history through all three credit bureaus.

All three

Yes

Monthly Subscription

Yes

A credit report and monitoring service that has most of the standard features that consumers expect. Credit reports from all three credit bureaus are provided for a monthly fee, but a free trial is available. The site has a simple and clean interface, unlike many of its competitors.

Seems to be lacking in some features, such as identity protection, which is unusual considering the price of the service.

Although lacking in some features, the free trial makes this service a must for those who need to try before they buy.

All three

No

Monthly Subscription

No

This site is a free online resource that strives to offer helpful content and comparison features to its visitors. Please be advised that the operator of this site accepts advertising compensation from certain companies that appear on the site, and such compensation impacts the location and order in which the companies (and/or their products) are presented, and in some cases may also impact the scoring that is assigned to them. The scoring that appears on this site is determined by the site operator in its sole discretion, and should NOT be relied upon for accuracy purposes. In fact, Company/product listings on this page DO NOT imply endorsement by the site operator. Except as expressly set forth in our Terms of Use, all representations and warranties regarding the information presented on this page are disclaimed. The information which appears on this site is subject to change at any time. More info

Equifax Credit Reports

Information Directly From A Credit Bureau

Many people who are looking to keep track of their credit histories are often unsure of exactly where to check. Most are not even aware of the three main credit bureaus that track their information, let alone their names. Some of them who do know about the three credit bureaus are not aware of how to check their credit history with each of them, sometimes just choosing credit reports from any random online site that offers such information.

Equifax, the oldest and most well-known of the big three credit bureaus, is aware of how difficult it can be to find your own credit history, and directly offers consumers a way to check their own credit histories and reports in a simple manner. Instead of having to use an often pricey third party, Equifax lets consumers check their own personal credit history directly from the source. Along with the free annual credit report that is mandated by the federal government, Equifax also offers a number of free services, including identity protection and fraud alerts, something that most other credit history agencies charge for.

Learn How To Keep Track of Your Credit

Along with the free and paid services provided by Equifax, a large amount of information is available that is geared towards educating consumers about how to keep track of their credit history and avoid situations that would negatively impact their credit scores. Although a number of their services are provided strictly for credit information that is tracked only by Equifax, they do offer a comprehensive credit report that compiles information from all three of the main credit bureaus. The credit report package can be pricey, but the value can still be felt when coupled with the free services that they provide.

One Of The Best Values Available

Instead of being a seemingly mysterious entity, Equifax is setting themselves up to be an open and clear leader in the credit reporting industry. Anyone wishing to get their own credit history directly from the source will find immense value in the additional tools that are provided.

Additional Info

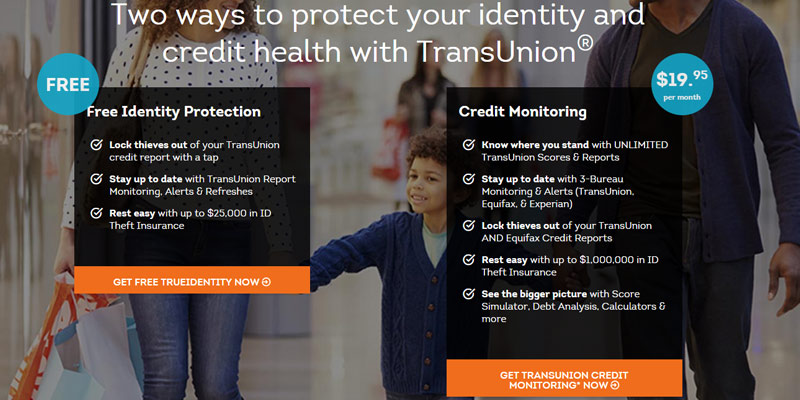

Trans Union Credit Reports

Protect Your Identity

Most people who have spent any amount of time online are aware of the risks of identity theft. With so much of today's commerce occurring online, and with security breaches of sensitive customer information in the news seemingly every day, the risk of having your identity stolen seems to be higher than it's ever been. With such risks come people's sensitivity towards protecting their identities. This is especially important when trying to find the right service for keeping track of your credit history while also protecting your identity.

Being one of the three main credit bureaus, TransUnion is well aware of the risks that people take when doing any kind of commerce online. That's why they have provided a convenient way for being able to track your credit history while also keeping your personal information safe and secure. With a very affordable monthly fee, they make it easy for anyone to sign up and maintain a close eye on their credit history in as safe and secure of a manner as possible.

Affordable Subscription Service

TransUnion provides consumers the ability to not only check their credit reports, but to also maintain their information security through an inexpensive monthly subscription. WIth the subscription, users can receive unlimited updates to their credit report, track their credit scores through TransUnion's Score Simulator, and even have identity insurance of up to $1 million, something that doesn't seem to be offered anywhere else. The service does have a few drawbacks, such as the possibility of credit scores tracked through their service not corresponding with those from other credit bureaus, but the total number of tools available for subscribers more than make up for any shortcomings.

A Terrific Value

Despite the fact that some of the tools provided in the subscription are available elsewhere for free, the complete set of tools that are provided makes this service a terrific value that few others are able to match. If you think the identity protection is worth the low monthly subscription price, then you will find this service invaluable.

Additional Info

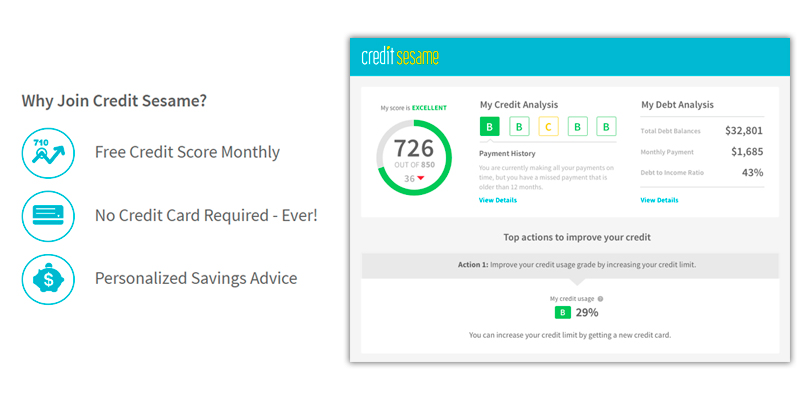

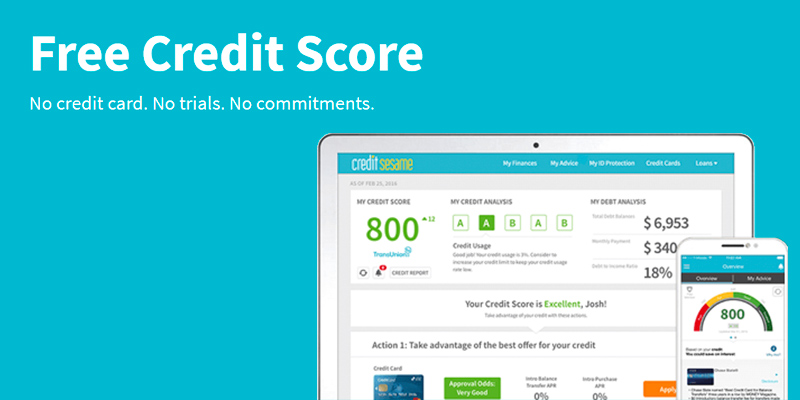

Credit Sesame Reports

Track Your Finances Easily

With all of the discussion about identity protection, there's another important aspect of tracking your credit history. Properly managing finances is something that many people tend to take for granted. Along with the proliferation of credit cards and loans that are available for consumers, it's easier than ever for people to quickly lose track of all of their credit. As more and more people fall into this trap and let their finances spiral out of control, it's more important than ever for them to keep a close eye on their spending.

Credit Sesame provides free tools for doing just this, allowing consumers to sign up and manage their finances while being able to keep track of their credit history. As something that's not provided to the same level by most of their competitors, they have another ace up their sleeve when it comes to why people should choose their service. There is absolutely no cost to the user for using any of the tools available with their service. Yes, that means that their service is completely free.

Completely Free Service

Credit Sesame is able to provide services that often require a one time payment or monthly subscription from many of its competitors by subsidizing the cost of the service through payments earned from banks. If a person is able to find and qualify for a loan through their service, they are paid a small percentage of that loan by the bank. This means that they have extra incentive for empowering consumers to take control of their complete financial picture, and are happy to provide these services at no cost to the end user. This kind of value is seldom seen elsewhere.

Take Control Of Your Finances

For a service with very few downsides, it's hard to find any kind of fault with the Credit Sesame Credit Report. Users are provided with free services and tools that are available only for a price through most other places, so there's no reason to not give it a try. Your bank account will thank you for it.

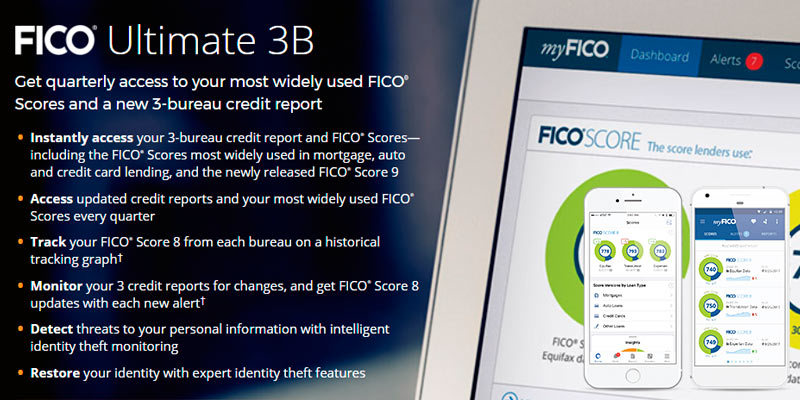

My FICO Credit Reports

Detailed Credit History

All of the services mentioned so far seem to have similar tools and features available to their users. Tracking credit history, identity protection, free monthly credit reports, and various other tools are all provided by almost all services of this type. Outside of a few small details, there doesn't seem to be much variation between them, with some services being better than others for certain specific cases. The MyFICO Credit Report can also fall into this category, but with an important difference.

Although there's been a lot mentioned about the services and tools provided by all of the other credit reporting agencies, there hasn't been much said about the necessity of keeping track of the fine details of your credit report. When tracking your credit history, the importance of seeing those small details such as the amount paid on loans and the total balance due is quite important. MyFICO is well aware of this fact, and their credit monitoring service allows people to see details that are often not available through their competitors.

Standard Features And More

Although the standard list of features included in this service is similar to its competitors, what really sets the MyFICO Credit Report service apart is in the details that are available in the credit reports. MyFICO provides a detailed credit report from all three of the main credit bureaus, with itemized listings that are often not available through other services. Along with the standard features such as a monthly credit score, identity protection, and credit monitoring, MyFICO also provides some nice additions including a mobile app and a toll-free number for consultation. The only downside of this service is the monthly subscription price, which is higher than some of its competitors.

No Detail Left Untouched

At first glance, the MyFICO Credit Report doesn't seem to offer much that is above and beyond other credit services, but as they say, the devil is in the details. The detailed credit reports provided are simply unmatched by anyone else. For anyone who needs to see these small details, it's safe to say that MyFICO Credit Report is your best bet.

Additional Info

My Free Score Now Credit Score

Service With A Free Trial

There's much to be said for any kind of service that has a free trial available before any payment is necessary, especially when it comes to anything that involves credit history. When people are signing up for any kind of service, there's often some kind of mystery about what exactly is offered, how easy it is to use, and other details that may not be readily apparent. Let's face it, most of us really need to see what we are getting ourselves into before any kind of monetary commitment is made.

Fortunately for those of us like that, My Free Score Now Credit Report provides a free trial for those who need to see what they are getting before putting any money down. After the very simple sign-up process, users are granted a seven day free trial in order to see what services are offered, check some basic information about their credit history, and determine whether or not this service is the right one for them. This provides a low risk way for those who are squeamish about what they're paying for to try things out.

Standard Features With A Monthly Subscription

When users sign up for the service, they are given a seven day free trial that can be cancelled at any time. This lets them check out the service to see the basic features offered. Although many of the standard features are present, including the monthly credit report and email notifications of changes in the report, the service does seem to be missing a few key features, most notably those involving identity protection tools. This might make the service less than ideal for those who find such tools a necessity, especially considering the monthly subscription rate in comparison to its competitors.

Try Before You Buy Despite the lack of identit

Despite the lack of identity protection features, many people may still see this service as the right fit for them, especially since they are able to try the service before committing to the monthly subscription. If you fall into this category, then My Free Score Now Credit Report may be just what you need.

Additional Info

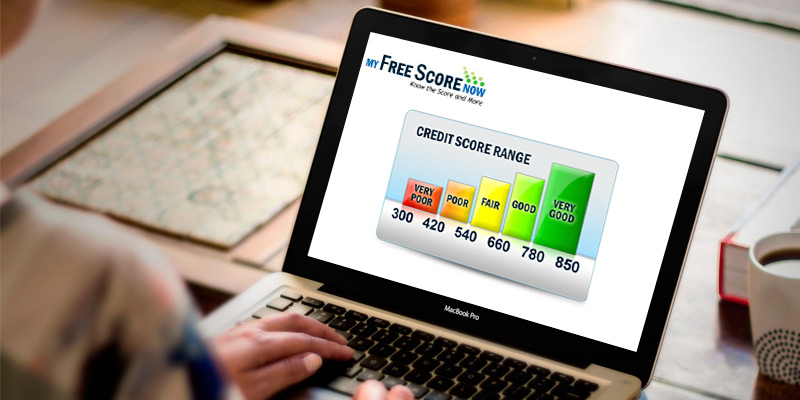

What Is a Credit Report?

A credit report is a basic listing of a person's credit history that gives a score indicating an individual's credit standing. This allows a person to review their own credit history, which usually focuses on the previous 7 years, and gives a score which indicates the level of risk that a person is deemed when issuing credit. This score is calculated based on the total amount of credit that a person has obtained along with the amount they currently have charged. Other factors, such as the timeliness of payments, paying a loan to completion, and the frequency and the amounts paid each month can also influence a credit score.

Although seeing the whole history of a person's credit is important, the biggest thing that most lenders will look at is the overall credit score. How high or low this score is will tell lenders how responsible of a borrower that a person is, and this, in turn, will affect things such as the total line of credit that will be extended along with interest rates. People with very high credit scores are often given preference for gaining a high credit line with low-interest payments, while those with low credit scores run the risk of being denied credit.

Your comment was successfully sent

Error! Please try again later